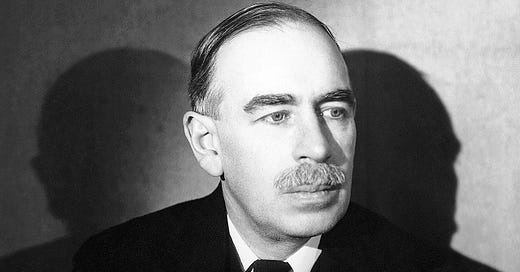

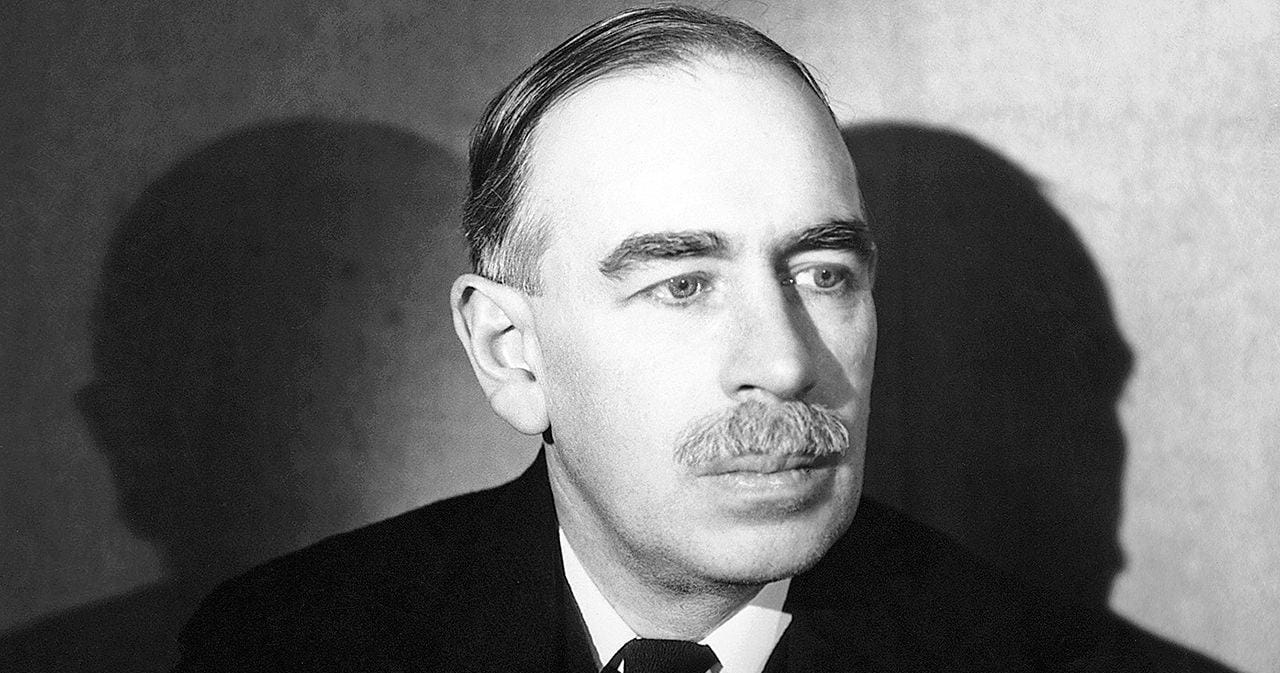

I have been rightly called out for recommending a text that is almost impossible to find on the internet; to remedy this, below are two letters from Keynes to fellow economist Roy Harrod, concerning economic methodology. For context, Keynes and Harrod had been discussing the econometric work of Jan Tinbergen (see a previous post on the Keynes-Tinbergen controversy), as well as Harrod’s own Presidential Address to Section F of the British Association in August 1938 entitled ‘Scope and Method of Economics’ (those with a JSTOR account can find Harrod’s address here)

…

To R. F. HARROD, 4 July 1938

My dear Roy,

There is no doubt that your Presidential Address, which I have sent to the printer, is very interesting; and it will provoke plenty of thought. Indeed it is much the best Presidential Address for many years. I am very glad to print it in full; but would remind you that it will take considerably over an hour to read at a reasonable pаce.

Sections III and IV I like without reserve. But in sections I and II, although I agree with nearly all your detail and your treatment within your own chosen terrain, I am not so clear that you have chosen or planned your terrain rightly.

It seems to me that economics is a branch of logic, a way of thinking; and that you do not repel sufficiently firmly attempts à la Schultz to turn it into a pseudo-natural-science. One can make some quite worth while progress merely by using your axioms and maxims. But one cannot get very far except by devising new and improved models. This requires, as you say, 'a vigilant observation of the actual working of our system'. Progress in economics consists almost entirely in a progressive improvement in the choice of models. The grave fault of the later classical school, exemplified by Pigou, has been to overwork a too simple or out-of-date model, and in not seeing that progress lay in improving the model; whilst Marshall often confused his models, for devising which he had great genius, by wanting to be realistic and by being unnecessarily ashamed of lean and abstract outlines.

But it is of the essence of a model that one does not fill in real values for the variable functions. To do so would make it useless as a model. For as soon as this is done, the model loses its generality and its value as a mode of thought. That is why Clapham with his empty boxes was barking up the wrong tree and why Schultz's results, if he ever gets any, are not very interesting (for we know beforehand that they will not be applicable to future cases). The object of statistical study is not so much to fill in missing variables with a view to prediction, as to test the relevance and validity of the model.

Economics is a science of thinking in terms of models joined to the art of choosing models which are relevant to the contemporary world. It is compelled to be this, because, unlike the typical natural science, the material to which it is applied is, in too many respects, not homogeneous through time. The object of a model is to segregate the semi-permanent or relatively constant factors from those which are transitory or fluctuating so as to develop a logical way of thinking about the latter, and of understanding the time sequences to which they give rise in particular cases.

Good economists are scarce because the gift for using 'vigilant observation' to choose good models, although it does not require a highly specialised intellectual technique, appears to be a very rare one.

In the second place, as against Robbins, economics is essentially a moral science and not a natural science. That is to say, it employs introspection and judgments of value.

I must stop writing. I do not expect you differ much from the above reflections, which show the lines along which your paper has set me thinking.

Yours ever,

J. M. KEYNES

…

To R. F. HARROD, 16 July 1938

My dear Roy,

I think we are a little bit at cross purposes. There is really nothing in your letter with which I disagree at all. Quite the contrary. I think it most important, for example, to investigate statistically the order of magnitude of the multiplier, and to discover the relative importance of the various facts which are theoretically possible.

My point against Tinbergen is a different one. In chemistry and physics and other natural sciences the object of experiment is to fill in the actual values of the various quantities and factors appearing in an equation or a formula; and the work when done is once and for all. In economics that is not the case, and to convert a model into a quantitative formula is to destroy its usefulness as an instrument of thought. Tinbergen endeavours to work out the variable quantities in a particular case, or perhaps in the average of several particular cases, and he then suggests that the quantitative formula so obtained has general validity. Yet in fact, by filling in figures, which one can be quite sure will not apply next time, so far from increasing the value of his instrument, he has destroyed it. All the statisticians tend that way. Colin [Clark], for example, has recently persuaded himself that the propensity to consume in terms of money is constant at all phases of the credit cycle. He works out a figure for it and proposes to predict by using the result, regardless of the fact that his own investigations clearly show that it is not constant, in addition to the strong a priori reasons for regarding it as most unlikely that it can be so.

The point needs emphasising because the art of thinking in terms of models is a difficult - largely because it is an unaccustomed - practice. The pseudo-analogy with the physical sciences leads directly counter to the habit of mind which is most important for an economist proper to acquire.

I also want to emphasise strongly the point about economics being a moral science. I mentioned before that it deals with introspection and with values. I might have added that it deals with motives, expectations, psychological uncertainties. One has to be constantly on guard against treating the material as constant and homogeneous. It is as though the fall of the apple to the ground depended on the apple's motives, on whether it is worth while falling to the ground, and whether the ground wanted the apple to fall, and on mistaken calculations on the part of the apple as to how far it was from the centre of the earth.

But do not be reluctant to soil your hands, as you call it. I think it is most important. The specialist in the manufacture of models will not be successful unless he is constantly correcting his judgment by intimate and messy acquaintance with the facts to which his model has to be applied.

I have every intention of writing my paper for Cambridge, but whether I shall turn up to read it in person is very much more doubtful. As regards your own address, I would strongly urge on you that it would be a much better plan to read a curtailed version and leave the audience to study a complete text of it later, than to recite the printed version at a great pacе, relying on the audience to follow in the text. In fact audiences do not follow in the text, if only for the reason that reading pace is quite different from speaking pace, even when the latter is accelerated. You want to catch the attention of the audience to the impact of your own personality on the text. The details of the latter they can pick up much more satisfactorily and completely when they get home.

Yours ever,

J. M. KEYNES

"The pseudo-analogy with the physical sciences leads directly counter to the habit of mind which is most important for an economist proper to acquire." That pseudo-analogy has conquered the field in the years since 1938.