The Desirability of Formalisation in Economics

On the prospects for economics in the Archimedean-Ptolemaic mode

I have become persuaded that a good introductory course in economics should also include at least one module on the philosophy of science. Joan Robinson, recent(ish) recipient of a blue plaque and source of seemingly perpetual controversy, once declared that ‘in a subject [economics] where there is no agreed procedure for knocking out errors, doctrines have a long life’. The philosophy of science may not be very useful at ‘knocking out errors’ in specific applications of scientific procedure, but it can go some way to taming those errors that arise from conceptual confusion, which, in the case of economics, are many and various.

In my imaginary Philosophy of Economic Science 101 my main headache would be deciding which essay to include from the great Patrick Suppes. One candidate is his short paper ‘The Desirability of Formalisation in Science’ (1968) which opens with the following memorable gambit:

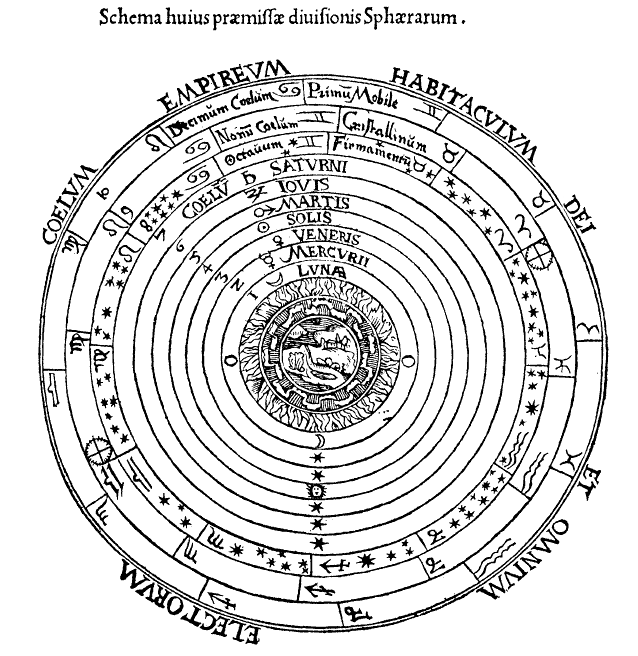

'It would be amusing to put the question whether formalisation in science is desirable to Archimedes in Sicily or some three hundred years later to Ptolemy in Alexandria. I can imagine Archimedes, in a characteristic turn of phrase, saying that no man of eminence in philosophy would ask such a question. It would be like asking if one wanted an actual demonstration in geometry as opposed to a suggestive but informal method. I think even Ptolemy, though much more deeply involved in empirical observations and the complicated problem of fitting theory to data, would answer in the same vein.'

P Suppes, ‘The Desirability of Formalisation in Science’, The Journal of Philosophy, Vol. 65, No. 20 (Oct 24, 1968)

In the spirit of Ptolemy and Archimedes - and it is surely time Ptolemy was given his dues as one of the greatest experimental physicists ever to have lived - Suppes argues that modern science has made itself vulnerable to conceptual confusion, having largely forgone the rigours of ‘formalising and axiomatising’ to rely instead on the pragmatic test of whether theories can be made to fit, control and predict the relevant data. Suppes does not use this language, but we could say that the Archimedean-Ptolemaic mode, which characterised ancient Hellenic science and was still the governing paradigm for men like Newton, has given way to a Baconian scientia operative where all that matters is getting the right results and bringing phenomena under our 'command' (as Bacon's maxim goes).

Suppes goes on to list the six fruits of building sound and formally articulated logical foundations for scientific theories, which I summarise below:

1. Explicitness: ‘To formalise a connected family of concepts is one way of bringing out their meaning in an explicit fashion.’ Suppes gives the example of Kolmogorov’s axioms in probability theory, which did not ‘resolve’ the field of probability as a whole, but ‘helped to raise the discussion to a new level’ of analysis.

2. Standardisation: Formalisation would standardise the terminology and methods of conceptual analysis not just within economics as a self-enclosed field, but in principle between economics and ‘different branches of science’. This would serve the high-order ambition of bringing about a ‘unity of science’, and would be the source of a rich fund of analogy for scientific discovery.

3. Generality: ‘Formalisation eliminates provincial and inessential features of the way in which a scientific theory has been thought about’ and can thereby render some controversies irrelevant by showing that they are formally indistinguishable or similar to the point of being functionally identical.

4. Objectivity: ‘Formalisation provides a degree of objectivity that is impossible in theories that are not stated in such fashion’. Where the science is concerned with ‘elementary concepts’ and material of high abstraction, it is not even clear that we are talking about the same thing without a suitable formalisation.

5. Self-contained assumptions: ‘Formalisation is a way of setting off the forest of implicit assumptions and the surrounding thicket of confusion’. Suppes also allows that this feeds into an intrinsic ‘instinct for craftsmanship that is hard to resist once it is developed’ and should not be ignored, having been the source of a considerable amount of scientific progress in the past.

6. Minimal assumptions: ‘Formalisation of a theory makes possible an objective analysis of what are the minimal assumptions necessary for statement of the theory’. This has an ‘aesthetic appeal’ (c.f ‘instinct for craftsmanship’), and as with ‘self-contained assumptions’ is a way of showing up the ‘ad hoc addition of new assumptions’ which is generally a sign of specious science.

Robinson would have been appalled by all of this because of her well-known distrust of (and lack of facility with) ‘mathematising’ economics. Her favourite saying was that because she knew ‘no mathematics [she] had been forced to think’, a fine witticism, when intended ironically, but not, I would argue, a good policy for doing science. I can imagine Suppes having no time for her demurs. As he puts it at the end of the paper, the ‘transcendental argument for formalisation in science’ is that it is the principle means to achieve ‘objective resolution of conflict’, which is something Robinson saw everywhere in contemporary economics. When we axiomatise we are explicit; when we are explicit we know precisely what we have assumed and what we have derived from those assumptions (and by what operations) and when we know that we can put our finger on the exact point where an argument breaks down or involves itself in logical error. Further, when two plausible theories are shown to be incompatible, having a full formal statement of the kind Suppes envisages allows us either to dissolve the conflict by discovering some sort of formal equivalency of underlying structure (Suppes uses the example of the controversy over the continuous mechanics of waves and the discrete mechanics of matrix representations in quantum physics) or choose between the two by showing up an inconsistency in one of the theories.

Robinson’s teacher, John Maynard Keynes, would have shared her skepticism, and in his case it would be backed by substantial mathematical training. In a previous blog I shared two letters Keynes sent to Roy Harrod in 1938, occasioned by Harrod’s essay on the ‘Scope and Method of Economics’ which he delivered as the Presidential Address to Section F of the British Association. The science that Keynes describes is an unusual and eccentric one, to be sure, especially when compared with the models of science (Archimedean and Ptolemaic) that Suppes put at the head of his essay:

‘It seems to me that economics is a branch of logic, a way of thinking; and that you do not repel sufficiently firmly attempts a la Schultz to turn it into a pseudo-natural-science. One can make some quite worth-while progress merely by using your axioms and maxims. But one cannot get very far except by devising new and improved models. This requires, as you say, 'a vigilant observation of the actual working of our system'. Progress in economics consists almost entirely in a progressive improvement in the choice of models.’

J M Keynes to R F Harrod, 6 July 1938

The first claim becomes less startling after you read the opening pages of A Treatise on Probability (1921), where Keynes also describes probability as the branch of logic concerned with the ‘degrees of rational belief about a proposition which different amounts of knowledge authorise us to entertain’. He does not say whether there is a special relationship between economics and probability, but both are alike insofar as neither makes use of arguments that aim at ‘demonstrative certainty’. Keynes makes two interesting points in the Harrod letters which, if correct, would suggest that we should not expect to make very attractive returns on a Suppes-style axiomatisation of economic theory. The first is that the ‘material’ to which economic theory is applied is not ‘homogenous through time’. In other words, unlike atoms and forces, which exhibit a sort of universal stability over time, economists are concerned with a moving target which is constantly evolving and revising the terms of its own intelligibility, and in doing so consigning previously useful (and otherwise consistent) theories to the scrap heap. The second argument, which is related and carries a great deal of weight for Keynes, is that economics is a branch of moral science. Here is the illustrative passage:

I also want to emphasise strongly the point about economics being a moral science. I mentioned before that it deals with introspection and with values. I might have added that it deals with motives, expectations, psychological uncertainties. One has to be constantly on guard against treating the material as constant and homogenous. It is as though the fall of the apple to the ground depended on the apple's motives, on whether it is worth falling to the ground, and whether the ground wanted the apple to fall, and on mistaken calculations on the part of the apple as to how far it was from the centre of the earth.'

J M Keynes to R F Harrod, 16 July 1938

I am by no means an expert in this area, but I imagine that motives, expectations and psychological uncertainties, all of which are controlled and in some way directed by ‘introspection’ and ‘values’, do not fit into any ready-made mathematical language very well. I will rely on the authority of a friend of Suppes, R Duncan Luce, (you can see them give 10 hours-worth of lectures on the philosophy of measurement on YouTube) who in a roughly contemporaneous essay wrote:

‘The language of sets does not always seem adequate to formulate psychological problems. Put so baldly, the statement is almost heretical since, in practice, set theory is the accepted way to formulate mathematical problems … and hence applied mathematical problems […] the boundaries of many of my “sets” and of the ones that my subjects ordinarily deal with are a good deal fuzzier than those of mathematics. Consider an experiment in which the subject is presented with a set of possible responses. This is a nice, unambiguous set of the sort that we are all conditioned to expect. But in a theoretical analysis of the subject's behaviour, it often seems far more reasonable to consider not this set, but the one he considered before making his choice. It is quite difficult to pin down just what elements are and are not members of that set, and I am not sure that it is possible in principle.’

R Duncan Luce, ‘The Mathematics Used in Mathematical Psychology’, The American Mathematical Monthly, vol. 71, No. 4 (April 1964)

Where does this leave us? I see two options – either (a) we assume that there is a mathematical language that will make a formalisation possible, and work on that problem or wait for it to be unearthed or (b) we are confronted with something basically impossible to clarify with ‘demonstrative certainty’, and that we have to throw out (or dampen down) Suppes transcendental aspirations, and live with the fact that for economics at the very best we can argue our case, even if this often falls short of ‘knocking out error’.

Nicely done. The math will never work, i.e., the second of your two possibilities seems to me correct, and for reasons you suggest. The objects in question are not of the same order (the sets are messy), and can be deemed so only for brief periods and with large numbers. Even things that appear stable and countable, paradigmatically units of a currency, in fact fluctuate with the price of and confidence in that currency. So we're back to Keynes, constantly checking the formalization against the world, or even Robinson, just talking about the world. Sigh. :)

But there's something else at work: right now, and for the foreseeable future, the academic and indeed financial game is big data and big compute. So "right enough" will rule.